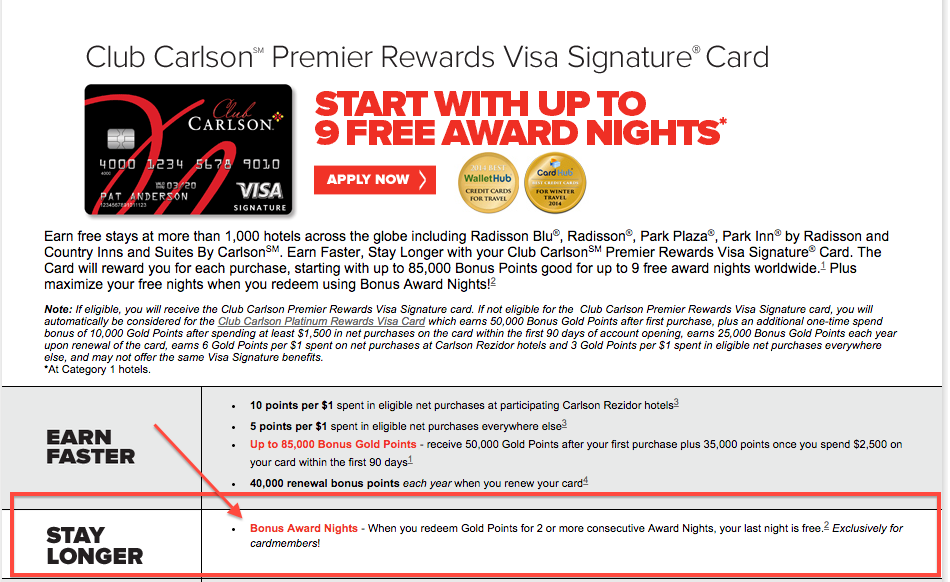

I just read on the Frequent Miler blog that massive changes are coming to the Club Carlson credit card. This is the first I’ve heard of it and am really hoping that it is a late April Fools joke. Ultimately, the potential changes is that the best feature of the card, the free night on every award reservation of 2+ nights is going away. This is single handily the best feature of any credit card out there. Ultimately, this is a buy one get one on all stays using your points. You can learn more about the benefits here.

They are saying that this feature will be replaced with a free night after you spend $10,000 on the card annually. This is a one time free night option per year. While this is typically a nice feature of a card and comparable to many other card benefits, this is by no means an even exchange.

I just reached out to my PR contact at Club Carlson to find out more about this possible change. In the linked blog post, a reader sent him his credit card statement which showed the change at the bottom of the statement. I have no yet received my latest statement to confirm this or not.

Anyone else notice a change in benefits on their credit card statement? My husband just applied for this card and no where was this change stated, so I am really hoping it is a bad joke. I also think they might have to do something for those that just applied for the card based on the terms stated when they applied.

I’ll let you know if I hear anything else.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Nooooooooooooooo!!!!!! This has become my #1 hotel chain because of this perk!

The change was just confirmed to me. We will have until June 1 to book reservations under the current program. From my perspective this takes most of the value out of the card. The hotels, for the most part, are average at best, so I will be thinking hard about whether the 40k annual bonus warrants the annual fee.

They have been pushing so hard with mailers and emails for me to sign up for their Visa..and I almost did…(decided to go with the IHG card this round) but this irks me that they would sell their points then bam!!! devaluation.

Of course I just got approved 2 days ago.

I just sent an email through the USBank website asking them to waive/pro-rate my annual fee due to the removal of one of the benefits of the card where the sign-up page does not show that the Award Night benefit is subject to change/removal at any time.

2 accounts, 1 for me, one for my gf were just opened in the past 2 weeks, so by the time those points hit, I won’t have use of the benefit and since a Credit pull was already done affecting my credit I asked that they waive the annual fee for those accounts as well as this amounted to bait & switch and I’d have no choice but to file a complaint with the FTC/State AoG office… ESPECIALLY as they still offer the benefit on their sign-up page even though the offer will expire in less than 2 months.

Disappointed! If it was getting to be too much for US Bank to handle, they should just stop offering that perk to new card applicants. It would have been much better PR. Why penalize and push away loyal customers?

This sucks, now I am stuck with all these points that have been devalued by 50% as I only use them when I am staying for 2 nights. I also wasted money twice by buying 100k points just for this perk.

My most recent card statement even had a flyer in it about how great this benefit is.