UPDATE: This offer has expired.

Earlier this month I wrote about some new and improved benefits to the Premier Rewards Gold Card from American Express. These enhancements include:

- Earn 2x Points at U.S. Restaurants. Previously you only earned 1x point when dining out, so earning double points is a nice addition.

- No Foreign Transaction Fees. This is not a deal breaker for me since there are already so many cards that offer no fee when using your card overseas, but I am glad to see this card join the bandwagon and waive all fees.

- $100 Airline Fee Credit. This is the biggest enhancement to the card in my opinion and really helps offset the high annual fee. This is a similar concept to the American Express Platinum card where you can receive up to a $100 credit per calendar year. Statement credits can include anything from checked baggage fees, lounge access, and in-flight purchases. I’ve actually even been reimbursed for airline gift card purchases. Since the credit is one-time per calendar year, you can actually receive the statement credit twice within the first year of card membership.

While 2x points at U.S restaurants and no foreign transaction fees is not a game changer or me, the $100 airline fee credit reimbursement is! This works very similar to the Amex Platinum card (if you are familiar) where you are reimbursed up to $100 in a calendar year on incidental purchases with your pre-selected airline. As mentioned above, incidental purchases can include checked baggage fees, lounge access, in-flight purchases, etc. But… in my case, I tried to test out the gift card purchase method as I did not want to worry about these small incidental purchases and it worked!

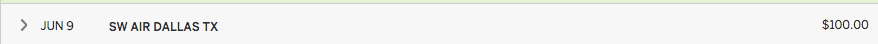

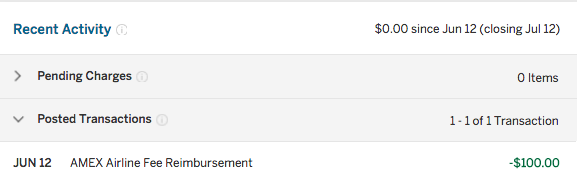

On June 9th I purchased a $100 gift card to Southwest and three days later on June 12th, the $100 was reimbursed.

Keep in mind that this doesn’t work with all airlines and there is an entire FlyerTalk thread dedicated to it. My personal experience is also current as of June 18, 2105. Reimbursement can always change per airline, so I suggest reading through your specific airlines FlyerTalk thread to ensure there are reports of it being reimbursed recently.

While the annual fee of this card is increasing by $20 and is now $195/year, having the $100 credit can offset the cost quite significantly. So in theory, you are really only paying $95 out of pocket ($195 annual fee minus the $100 airline fee credit) to have the card and can easily make that up (and more!) with the American Express statement credit offers that I write about often! And remember, for those that are just looking to apply for the card now, the annual fee is waived for the first year. You also get the $100 reimbursement once per calendar year, so if you were to apply for the card in the middle of a calendar year, you could get the $100 reimbursement twice prior to paying the $195 annual fee.

More about the card…

Even with a high annual fee, this is still a solid card. You will earn 3X points for flights booked directly with airlines, 2X points at US gas stations, US supermarkets, and US restaurants, and 1X points on other purchases. If you pay for travel a decent amount, then this is a great card to have to pay for all your airfare.

This card earns American Express Membership Reward points which allows you to transfer points to many partner airlines. Airline partners include: Air Canada, Singapore, ANA, British Airways, Iberia, Delta, Air France/KLM Flying Blue, Alitalia, Aeromexico, Virgin Atlantic, Virgin America, El Al, Frontier, JetBlue, Hawaiian. With Membership Reward points, you’ll get the best value when you transfer to airlines since the transfer rate is very low for hotel partners. Although at some point throughout the year, there might be a bonus transfer opportunity which makes transferring to a partner a better value. Partner hotels include: Best Western Rewards, Choice Privileges, Hilton Honors, and Starwood Preferred Guest. From time-to-time they also offer some extremely lucrative bonus transfer opportunities to airlines, although they are not as common as they used to be (for example the most recent 50% bonus with British Airways Avios).

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Does this also work when purchasing a $100 gift card for Alaska Airlines? Thanks.

I used it to pay for the early bird checkins on SW for 4 round trips. It took two business days for them to issue credit. Sweet!

You forgot to remind people that they can check 1) https://www.creditcards.com/cardmatch/ , and 2) if they already have one Amex credit card (not prepayed ones like serve, bluebird and redbird) their Amex account — to see if they are offered the higher offer of .

Curious why you didn’t mention this?

Thanks for the post.

@David – I am working on another post that talks about getting a higher offer with CardMatch, just need to finish it.

apologies:

50,000 points for only $2,000 spend – went missing in above post.

oops again.

correction: 50,000 points for only $1,000 spend

I still can’t find information whether this works for Hawaiian ;(

I did the same with southwest. Its been 4 days and nothing yet. Should I be worried??

@adrian – I would give it a few more days. I think you’ll be fine.

I purchased a $50 Southwest gift card on Aug 31 2015 and still not reimbursed 6 days later. I noticed on the charge that it assigned it a ticket number so maybe southwest doesn’t work anymore. I applied for global entry on the same day and that got refunded 2 days ago.

@Jeremy – It probably should have gone through by now, but maybe give it a few more days. With that being said there is an entire thread about Southwest gift cards being reimbursed. I read through the most recent posts and there are many people saying that they still have not received their credit. There is a chance that Amex will no longer reimburse for Southwest gift card purchases. http://www.flyertalk.com/forum/american-express-membership-rewards/1300482-200-airline-fee-reimbursement-reports-wn-fl-southwest-only-28.html

I selected Delta airlines as my airline for incidental reimbursements. I purchased two $50.00 Delta E-gift cards around September 20th, 2015. I did get the charges reimbursed. I had to wait till the statement came out to get reimbursed. The charges did not get credited back instantly or as soon as they posted. I got my statement credits yesterday on October 10th, 2015. Thought I would let everyone know that gift card purchases worked for me recently with Delta.

Can I use the $100 incidentals to pay for global entry? Thanks.

@Seb – You need to select a specific airline.