Information about this card has been collected independently by Deals We Like. The issuer did not provide the details, not is it responsible for their accuracy.

UPDATE: This offer has expired and the refer-a-friend link is now offering 40,000 points and the “Rose” Gold color is no longer available.

This is a reminder that the you have just 1 week left to apply for the very popular American Express Gold Card and get the “Rose Gold” metal type! Not only that, the increased 50,000 40,000 point offer by applying through a refer-a-friend link is also expiring then too. After January 9th, you will no longer be able to get the “cool” Rose Gold color and I suspect that the referral offer will decrease as well. I just got the card last month and it is by far the best card for those looking to maximize their restaurant and grocery store purchases.

NOTE: Make sure to apply through a refer-a-friend link as it will give you 50,000 40,000 points — the publicly available offer is only for 25,000 35,000 points!

Maximize Your Points and Statement Credits!

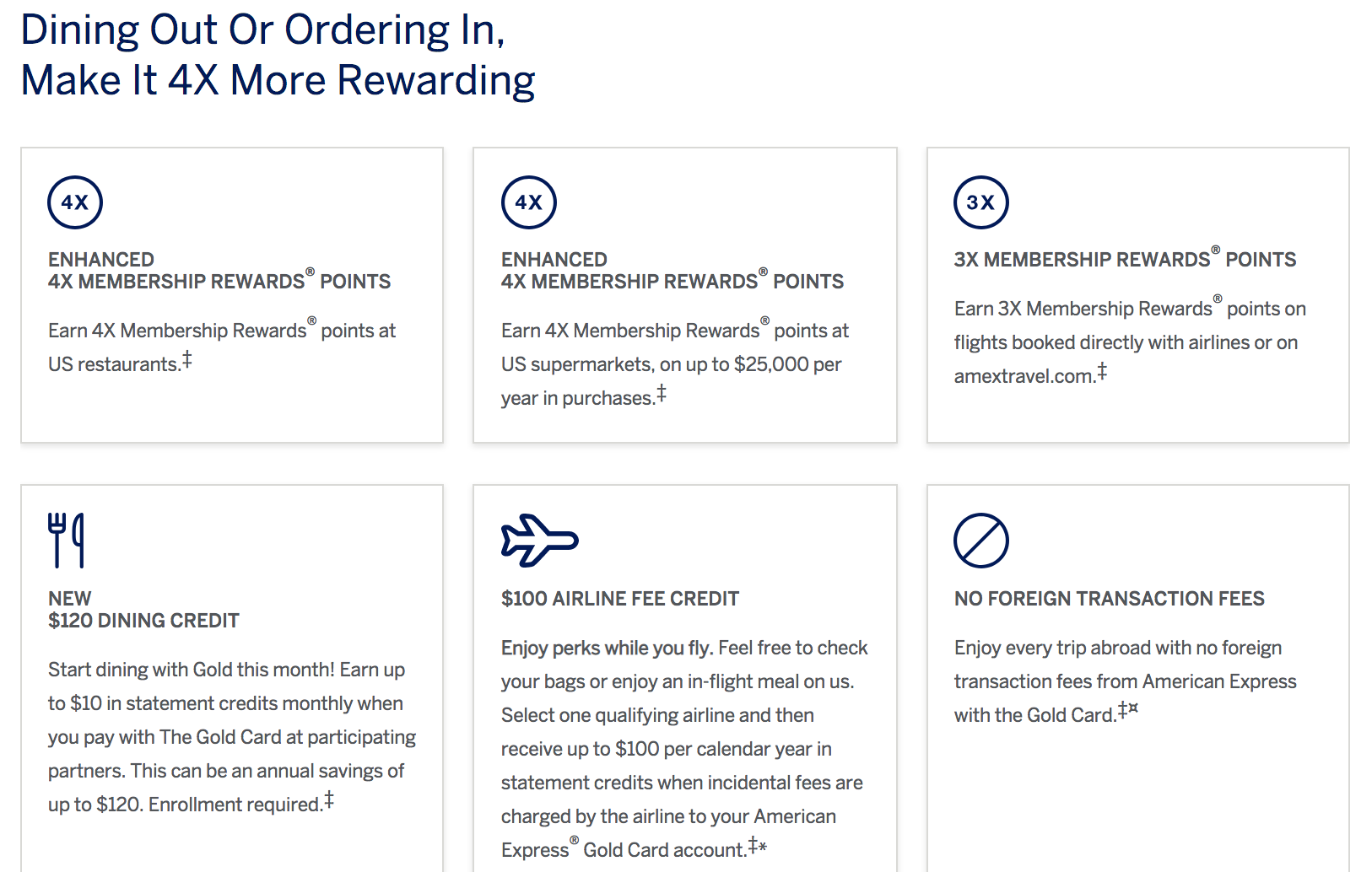

This is one of the richest cards cards for restaurant and supermarket purchases. With this card, you’ll receive:

- 4X Membership Rewards points at U.S. Restaurants

- 4X Membership Rewards points at U.S. Supermarkets (on up to $25,000 in purchases annually, then earn 1x points)

You’ll also earn up to $10 per month in statement credits when you use your card at eligible dining partners. Assuming you are able to maximize the statement credits earned, this will give you a $120 dining credit every single year. Some participating locations include Shake Shack, The Cheesecake Factory, Ruth’s Chris Steak House, and Grubhub/Seamless Web. Unfortunately, the credits cannot be combined from year to year, but I am going to test out purchasing a $10 gift card to Cheesecake Factory (in-store) which I believe will trigger the statement credit (although I have no tried it I am pretty confident that they process a gift card purchase in-store the exact same way as any other food purchase). This will then allow me to use combined gift cards on a few dinners out at this restaurant — we do not go to this restaurant monthly, but we do typically go a few times a year so this will work great for my family.

This card also gives a nice 3X Membership Reward point bonus on flights booked directly with airlines on amextravel.com. Although, I prefer to use a credit card which carries travel protection, and this card does not. This means I definitely will not be using this card for travel.

Similar to many other American Express credit cards, you’ll also receive up to a $100 airline fee credit per year. This is good for incidental fees at your selected airline. It works the exact same as the statement credit received from the American Express Platinum card and the existing American Express Premier Rewards Gold card. The $100 airline fee credit runs on a calendar year, not a cardmember year. This means you can get the credit immediately after being approved for the card and you can get it again next January 1st before your card anniversary even hits — giving you a total of $200 credits within the first year! Just remember that you must select your airline of choice for the year and that the credit is supposed to be used for incidental charges on that particular airline. Note that purchasing gift cards does not trigger the statement credit for all airlines, but their is an entire FlyerTalk thread which discusses what will and will not work. Based on data points as of today, gift card purchases work on: Southwest, Delta ($50 maximum), and American ($100 maximum). I was able to purchase a Southwest gift card and had success.

To Apply Through the Better 50,000Â 40,000 Point Offer

While the publicly available offer is for 25,000 35,000 Membership Reward Points, I’ve written about the opportunity to actually earn even more points with the card! So if you are going to apply for this card, DO NOT apply through a link that will only give less points. Many other sites are not advertising the better offer, so steer clear of any bloggers link that is not disclosing to you the better opportunity!

- Click on my personal referral link to see almost all American Express credit cards (it might bring up an offer for another Amex card)

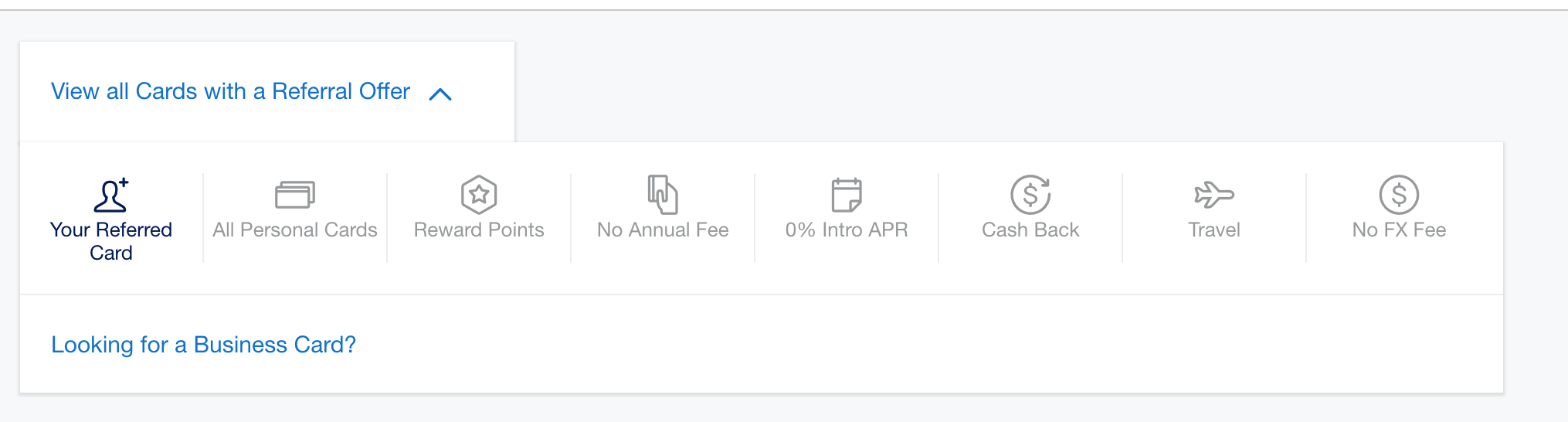

- Click on the “View all Card with a Referral Offerâ€Â (you might have to swap to the personal cards view if you are on a business card referral).Â

- Click on “All Personal Cardsâ€

- You’ll see the American Express Gold Card

50,000Â 40,000 point offer on the top row of the right-hand side (if not, just scroll down a little).

My Thoughts

I love the concept of the Rose Gold, although it is by no means the sole reason to get the card. But I must admit, it is a very desirable looking card! While there is a $250 annual fee, on a yearly basis you’ll receive up to $220 worth of statement credits ($120 on dining credits + $100 on airline fee credits). In just the first year, you’ll receive the following:

50,000Â 40,000 bonus Membership Reward points as part of the welcome offer- $100 statement credit for my airline purchase in January 2019 (or whenever throughout the year)

- $100 statement credit for your airline purchase in January 2020

- $130 in total statement credits for dining purchases throughout the year (given in $10 increments for 13 months between January 2019 and January 2020)

$100 in total statement credits for U.S. Restaurant purchases for my first 3 months (you can always purchase gift cards to your favorite restaurant in-store to use at a future time).

So in just the first year of cardmember, you’ll receive a total of $430Â $330 in statement credits and 50,000Â 40,000 Membership Reward points. I value my Membership Reward points at a conservative 1.5 cents per point, so in my book they are worth around $600.

Disclosure: This post contains refer-a-friend links where I will receive bonus points if you apply and are approved through the link. As always, thank you for supporting Deals We Like and enjoy traveling on a deal!

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Ahh bummer! I’ve waited on getting this card until there was a better bonus offer than the 25k so I clicked through your link and was given a message that said:

“Based on your history with American Express welcome offers, introductory APR offers, or the number of cards you have opened and closed, you are not eligible to receive this welcome offer. We have not yet performed a credit check. Would you still like to proceed?”

I haven’t kept up as much with travel card goings-on so maybe something has been written about this kind of message, but I’m curious what they mean by cards opened and closed – just for Amex or across the board? I’ve only closed the now-defunct SPG card and currently hold a downgraded free Blue Cash card and the Delta Gold. So I’ve never had this one before which would obviously exclude me. I’m going to give them a chat out of curiosity to see what’s up.

@Carolyn – It probably means you had the American Express Premier Rewards Gold card in the past?