UPDATE: This offer has expired.

The Chase Freedom credit card has just increased their sign up offer to 20,000 points after you spend $500 on purchases in your first 3 months from account opening. Additionally, you’ll earn a $25 bonus after you add your first authorized user and make a purchase within the same 3-month period. This is double the typical sign up offer! I was told that this is a limited time offer, but have not yet been given an end date.

The Chase Freedom credit card is a desirable cash back card especially with their 5% quarterly bonuses. The current 2014 bonus spend categories include:

- January-March: Gas Stations, Movie Theater, Starbucks

- April-June: Restaurants, Lowes

- July-September: Gas stations, Kohl’s

- October-December: Amazon.com, Zappos, Select department stores

For each bonus category you will receive 5x points up to $1,500 spend. The good thing is that these cover typical spending categories, i.e, gas, groceries, travel, etc. For example, if you spend $1,500 on gas between July and September, you will earn a total of 7,500 Ultimate Reward points (1,500 from regular spend and 6,000 bonus points). That is a great bonus!

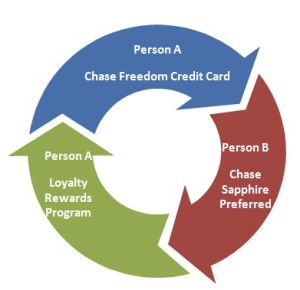

While cash back is great and you earn 1 cent per point earned, there is a roundabout way to potentially get a better value out of your points by transferring to a partner loyalty program. If you or your significant other has the Chase Sapphire Preferred or Chase Ink Bold or Chase Ink Plus, your points could become more valuable! This is because you are able to transfer the points earned from your Chase Freedom account to one of those three “enhanced” accounts and then from there transfer them to a partner loyalty program (which include: United, Southwest, British Airways, Korean Air, Virgin Atlantic, Singapore Airlines, Hyatt, Marriott, Ritz-Carlton, and InterContinental Hotel Group). When transferring points from an Ultimate Rewards account to a loyalty program, you can transfer to anyone’s award account; the names do not have to match. So essentially, you can do a full circle and transfer points from your Chase Freedom account to your preferred loyalty program!

These links discuss in more detail the best airline and hotel transfer partners, along with an introduction to the Chase Ultimate Rewards program.

So if you already have one of the “enhanced” cards, why would you get the Chase Freedom card? For non-bonus categories, it really does not matter if you use your Chase Freedom, Chase Sapphire Preferred, Chase Ink Bold, or Chase Ink Plus, but for the bonus spend categories, make sure you use the Chase Freedom card to get the 5x points! Each quarter you MUST activate the bonus categories – do not forget! If you do not manually activate the 5x points, they will NOT be posted to your account.

This card also comes with no annual fee so is one you can keep for years to come without having to pay on a yearly basis.

Key Links:

- Chase Freedom Visa application – 20,000 bonus points with $500 spend in 3 months; no annual fee

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

If you applied within the last 90 days, send a secured message to get it matched.