UPDATE: This offer has expired.

The Chase Freedom Flex and Chase Freedom Unlimited have become two incredibly popular no-annual fee cards due to their lucrative bonus categories. And not only are they great cards to have normally, they are both currently offering top-notch welcome offers where you can earn up to 80,000 points, each. This is worth a minimum of $800, or if you have a more premier Ultimate Reward credit card, such as the Chase Sapphire Preferred, it can be worth almost double. However, this offer is set to expire today.Â

- Chase Freedom Flex: Earn a $200 Bonus after you spend $500 on purchases in your first 3 months from account opening; plus earn 5% cash back on grocery store purchases (not including Target or Walmart purchases) on up to $12,000 spent in the first year.

- Chase Freedom Unlimited: Earn a $200 Bonus after you spend $500 on purchases in your first 3 months from account opening; plus earn 5% cash back on grocery store purchases (not including Target or Walmart purchases) on up to $12,000 spent in the first year.

Moving forward, the offer will still include the 20,000 bonus points after meeting the minimum spend, but it will not include the 5x points on grocery store purchases, which is the real appealing part of the offer.

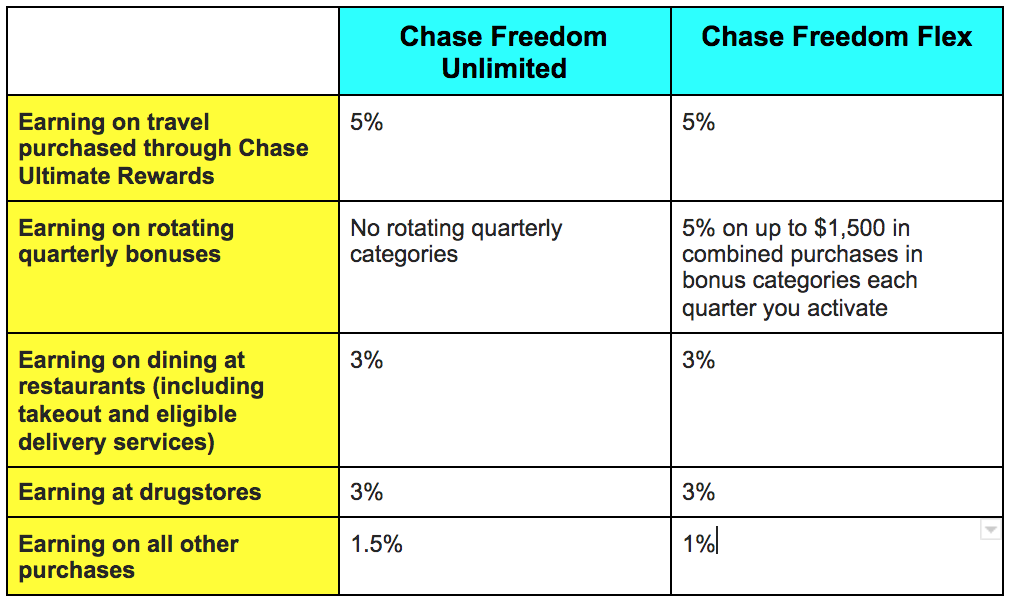

With the exact same offer on both cards, here are the similarities and differences.

Earn many Chase Ultimate Reward points

Although this card technically earns cash back, if you have a more premier Chase Ultimate Reward card, such as the Chase Sapphire Preferred, Chase Sapphire Reserve or Chase Ink Preferred, you can transfer your points to one of those accounts instead and then redeem for travel opportunities at a better rate.

For example, although you earn $200 cash back as part of the welcome offer, that really earns you 20,000 Chase Ultimate Reward points. Or, if you are able to maximize the 5%/5x cash back at grocery stores, that’ll actually yield you an additional 60,000 points throughout the year. You can either opt to redeem those points for cash back, or if you want, you can transfer them to a premier Chase credit card. You’ll then have up to 80,000 points to transfer to partner programs, such as Hyatt, Marriott, United, JetBlue, Southwest, British Airways and more.

With Chase Ultimate Reward points worth approximately 2 cents apiece if transferred to partner programs, this will earn you up to $1,600 towards travel.

Chase Freedom Flex vs. Chase Freedom Unlimited

Both are great no-annual fee cards, but the real difference comes down to the points you’ll earn with your every day spend. Ultimately, the Chase Freedom Flex shines with its 5% cash back on rotating categories. Of course though it takes more effort to maximize your points, but with a little bit of effort, you can truly earn a decent amount of points over the year (capped at $1,500 spend per quarter). For example, this quarter (July – September 2021), you’ll earn the increased bonus points at grocery stores (also excluding Target and Walmart) and select streaming services. (Yes, you’ll receive a total of 10% cash back on grocery store purchases during Q3, up to the cap).

The Chase Freedom Unlimited, on the other hand is more simplistic, where you’ll pretty much earn 1.5% cash back on all everyday purchases. No need to pay attention to category bonuses and instead you’ll earn an inflated amount regardless of the merchant.

Both cards will also earn you 3% cash back on drugstores, 3% cash back on dining out or takeout (including eligible delivery services) and 5% on travel booked through Chase Ultimate Rewards.

You’ll also notice that the Chase Freedom Flex has a leg up in the benefits department where you’ll receive cell phone insurance. This insurance protection allow you to be reimbursed up to $800 per eligible claim in case your phone is damaged or stolen. Although you are capped at $1,000 in reimbursement per year, this is a great perk to have and something that doesn’t come with the Chase Freedom Unlimited card. It is also a rarity to see this benefit on a card that is completely free to have.

Final words

Both of these are great cards to have and the best one for you truly depends on your spending habits. Although my recommendation for the majority of people is the Chase Freedom Flex due to the the rotating category bonuses and cell phone protection — if you are willing to pay attention to the quarterly bonuses.

And with such an increased bonus offer, now is a great time to apply for one of these two cards — or both if you prefer.

Chase Freedom Flex

Disclosure: This post contains affiliate links. As always, thank you for supporting Deals We Like and enjoy traveling on a deal!

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.