Currently the Chase Sapphire Reserve® is offering 60,000 bonus points. With points worth a minimum 1.5 cents apiece, this means you can use the points earned from the Chase Sapphire Reserve bonus towards $900 towards travel.

What are 60,000 points from the Chase Sapphire Reserve bonus worth?

With the Chase Sapphire Reserve credit card, there are two popular ways to redeem your points: 1) redeeming your points through the Chase travel portal; 2) transferring your points to a partner program.

When using your points through Chase’s travel portal points are worth a fixed 1.5 cents apiece. This is why the 60,000 points earned are worth $900 towards travel. You can use your points to book any hotel or airfare.

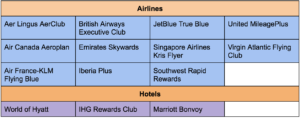

However, if you want to potentially receive a higher valuation from the welcome offer, you can instead transfer your points to one of 14 partner loyalty programs. I personally value many of the below programs to be worth approximately 2 cents per point, putting a $1,200 valuation on the 60,000 points welcome offer. You can learn more about my take on the redemption values for airlines here and hotels here.

Chase Sapphire Reserve card benefits

Despite a $550 annual fee, the card offers many luxury benefits. For starters, you’ll receive a $300 annual travel credit. This can be used on anything that codes as travel, making it incredibly easy to use. This credit alone effectively allows you to think of the annual fee costing just $250 per year — a more reasonable amount to lay out for a single credit card.

You’ll also receive a complimentary Priority Pass Select membership which allows you to access over 1,300 airport lounges worldwide. You’ll also earn up to $100 in credits for a Global Entry or TSA PreCheck membership (which is valid once every four years). So in your first year alone, that knocks another $100 in savings.

Cardmembers will also receive a complimentary DoorDash DashPash subscription for 12 months (when activated by Dec. 31, 2024) as well as $5 in monthly statement credits on DoorDash purchases (through Dec. 31, 2024). If you use DoorDash often enough for food delivery, this is up to another $60 in savings.

Travel and shopping benefits

When using your card for a purchase, you’ll also receive strong travel and shopping benefits. For example, when you use your card for a covered item, you’ll be covered against damage or theft for up to 120 days after you make your purchase (up to $10,000 per claim).

On the travel side, another favorite is the trip delay insurance. With this benefit, if your trip is delayed more than 6 hours or requires an overnight stay, you and your family are covered for unreimbursed expenses, such as meals and lodging, up to $500 per ticket. For many other credit cards, this benefit doesn’t kick in unless a 12-hour delay.

Additionally, with the trip cancellation/interruption insurance, if your trip is cancelled or cut short by sickness, severe weather and other covered situations, you can be reimbursed up to $10,000 per trip for your pre-paid, non-refundable travel expenses, including passenger fares, tours, and hotels. This is a huge benefit that can definitely come in handy in the event of an unfortunate situation.

Other travel benefits include primary auto rental collision damage waiver, baggage delay insurance, roadside assistance, lost luggage reimbursement, travel and emergency assistance, travel accidence insurance, emergency evacuation and transportation and emergency medical and dental coverage.

Chase Sapphire Reserve point earning

The Chase Sapphire Reserve has a strong program when it comes to earning points — especially since you’ll be earning Chase Ultimate Reward points which are extremely valuable. And if you have Chase Ultimate Reward points earned from another Chase credit card, such as the Chase Sapphire Preferred, Chase Freedom Flex or Chase Freedom Unlimited, you can freely transfer your points over to the Sapphire Reserve for a higher redemption.

- 3x points for every dollar you spend on dining, or 10x points if booked through Ultimate Rewards

- 3x points for every dollar you spend on travel (after the $300 travel credit), or 10x points total on hotel and car rentals and 5x points on flights if purchased through Ultimate Rewards

- 10x points per dollar you spend on Lyft rides (through March 2025)

- 1x point on all other purchases

Overall…

With the Chase Sapphire Reserve bonus enabling you to earn 60,000 bonus points, this is a great opportunity to apply for the card — especially since you’ll receive a minimum of $900 in travel immediately upon meeting the minimum spend requirement. Those points can be redeemed for a roundtrip flight to Europe or some great hotel stays at a Hyatt. One of my personal favorite ways to redeem my Chase points is by transferring to Hyatt. They have an incredibly favorable award chart, where for example, you can stay at their amazing Ziva or Zilara all-inclusive properties.

Learn more about the Chase Sapphire Reserve®

Of course the annual fee is quite high, but if you are able to maximize the $300 travel credit, $100 Global Entry or TSA PreCheck fee credit, Priority Lounge access and the up to $60 per year DoorDash credit, the fee is looking significantly better. And after the first year with the card, if you find you aren’t getting a good enough value, you can alway downgrade to a lower annual fee card.

Disclosure: This post contains affiliate links. As always, thank you for supporting the blog and enjoy traveling on a deal.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.