Right now there are a ton of increased credit card offers available! Below is a recap of some great credit cards and offers for the month of October.

70,000 Delta Miles + Companion Certificate Every Year

Key Links: Blog Post

UPDATE: This offer has expired. Both the Platinum Delta SkyMiles® Credit Card from American Express and Platinum Delta SkyMiles® Business Credit Card from American Express have a limited time offer which expires November 8, 2017. With this offer you can earn 70,000 bonus miles after you spend $3,000 in purchases on your new Card in your first 3 months. Additionally, you’ll earn 10,000 Medallion® Qualification Miles (MQMs) after spending $3,000 on the card and a $100 statement credit after you make a Delta purchase with your new Card within your first 3 months. This card comes with a $195 annual fee.

With the Platinum version of the card you’ll receive a companion certificate upon account renewal (so you won’t receive it the first year, it starts the second year you have the card and every year thereafter after renewing the card and paying the annual fee). This will give you a domestic economy class ticket that can be used within the 48 contiguous states. While you will have to pay applicable taxes/fees they are minimal and will not cost more then $75. Essentially, the companion ticket can be used for anyone and is not limited to just the Delta cardmember. You are allowed to gift the companion pass to two friends to fly together if you desire. However, the tickets must be purchased with your Delta credit card. You can learn more about the companion certificate here.

Another perk of the Platinum card are both the MQMs you’ll receive as part of the limited time offer as well as the annual MQM boost. If you spend $25,000 on the card in a calendar year, you’ll get an extra 10,000 MQMs. If you spend $50,000 on the card in a calendar year, you’ll get an additional 10,000 MQMs. That means you can earn a total of 20,000 MQMs every single calendar year PER Platinum card – that is if you are able to spend that that much on the card!

60,000 Delta Miles

Key Links: Blog Post

UPDATE: This offer has expired. Both the Gold Delta SkyMiles® Credit Card from American Express and Gold Delta SkyMiles® Business Credit Card from American Express credit cards are offering a limited time offer where you can earn up to 60,000 bonus miles through November 8, 2017. With this offer, you’ll earn 50,000 bonus miles after you spend $2,000 in purchases with your new Card within your first 3 months and then another 10,000 bonus miles after spending another $1,000 in purchases within your first 6 months. Additionally, you’ll earn a $50 statement credit after you make a Delta purchase with your new Card in your first 3 months. There card comes with a $0 introductory annual fee for the first year, then $95. *Terms Apply.

While this card does not have the same unique benefits of the Delta Platinum card (as mentioned above), you’ll still get free checked bags, priority boarding, and the ability to take advantage of Amex Offers where you receive a statement credit at many popular merchants. And since this card comes with no annual fee the first year it is a great way to increase your Delta balance to take that free flight!

35,000 SPG Points

UPDATE: This offer has expired.

Key Links: Blog Post

The Starwood Preferred Guest® Business Credit Card from American Express has a limited time offer where you can earn up to 35,000 bonus points through November 1, 2017. With this offer you’ll earn 25,000 bonus Starpoints® after you use your new Card to make $6,000 in purchases within the first 3 months. Plus, earn an extra 10,000 bonus Starpoints® after you make an additional $4,000 in purchases on the Card within the first 6 months. There is a $0 introductory annual fee for the first year, then $95. This is the highest offer you’ll see for the card and it is only available for the business version of the card, not the personal version. *Terms Apply.

There are two reasons why the business version is significantly better then the personal version:

- Lounge Access: Back in 2015 a new perk was just added to just the business version of the Starwood credit card. With this benefit, you’ll receive COMPLIMENTARY club lounge access at all Sheraton hotels worldwide. If you stay at Sheraton hotels and do not have top tier status, this can be a HUGE perk as you will receive complimentary daily breakfast, a premium selection of beverages, and evening hors d’oeuvres. There are also snacks throughout the day and free WiFi access. As long as you book directly with Starwood, you are given this benefit (regardless if it is a paid stay, or a stay using points or cash + points). I personally have found Sheraton lounges to be spotty throughout the US, but international lounges are typically top notch. You can read more about this complimentary lounge access here.

- OPEN Savings: With the business version of the card (as well as all other business American Express credit cards) you are eligible to American Express OPEN savings. This gives you 5% statement credit when you use your card at many merchants, including: FedEx, Hertz, 1-800-FLOWERS, Barnes & Noble, etc.  All you have to do is make the purchase with your OPEN credit card and you’ll receive a statement credit for your purchase.  You can read more about AMEX Open savings here.

60,000 American Airline Miles

Key Links: You can learn more about airline credit cards here

All three cards are offering a high sign up bonus where you can earn 60,000 bonus miles. That means you can earn a total of 180,000 American Airline miles if you apply and are approved for all three! The two Citi cards come with no annual fee for the first year and then a $95 annual fee thereafter. The Barclaycard version comes with a $95 annual fee that is NOT waived the first year. With that being said the two Citi cards require a minimum spend to meet the sign up offer where the Barclaycard version just requires you to make a single purchase do earn the miles.

The real benefit of this card, aside from the sign up bonus, is that if you are a cardmember you’ll receive 10% back of the miles redeemed for the year. Although you are capped at 10,000 miles per year. If you redeem a ton of miles per year, this rebate will make up for the annual fee. With these cards you’ll also get free checked bags and priority boarding.

Remember, with Citi cards you are not able to receive a sign up bonus if you’ve had the same card in the past 24 months (even if it has been canceled). Citi does not allow you to be approved for more then 2 of their cards within a 60 day period and more then 1 card per week. So if you are looking to apply for both of the Citi cards make sure to wait 8 days between.

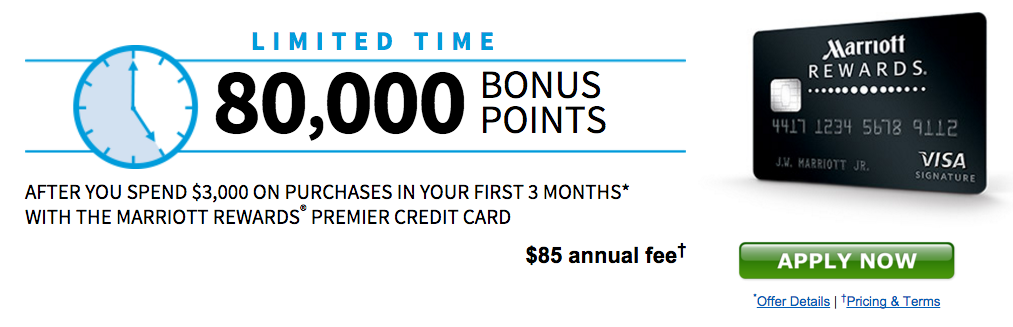

80,000 Marriott Points + Category 1-5 Free Night Every Year

Key Links: Blog Post; Application link

With the Marriott Rewards® Premier Credit Card you’ll earn 80,000 Bonus Points after you spend $3,000 on purchases in the first 3 months from account opening. Plus, earn 7,500 bonus points when you add the first authorized user and make a purchase in the first 3 months from account opening. This card comes with a $85 annual fee. Also, if you prefer Starwood hotels, you can transfer your Marriott points to Starwood at a 1:3 ratio.

Similar to the other travel credit cards above, this card also comes with a free night certificate every single year which you are a cardmember (starting with your first anniversary year). The free night certificate is limited to a category 1-5 property, so it is restricted but you should not have a problem getting at least a $85 value out of the free night.

Card benefits include:

- Category 1-5 free night certificate every year

- 15 nights a year towards status, which gives you automatic Silver status

- Earn 1 night towards status for every $3,000 you spend on the card

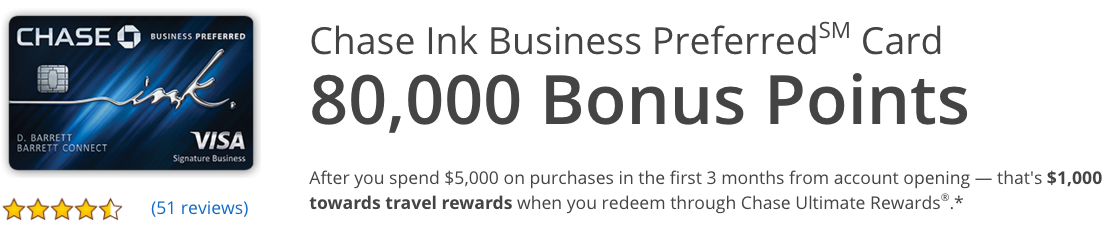

80,000 Chase Ultimate Reward Points

Key Links:Â Blog Post; Application link

With the Chase Ink Business Preferred card you’ll earn 80,000 Chase Ultimate Reward points after you spend $5,000 on the card within the first 3 months. This is one of the best credit card offers out there right now and the highest way to earn Chase Ultimate Reward points. With Chase points, you can either use your points to book through their travel portal where 1 point is worth a fixed 1.25 cents towards your trip or you can transfer your points to their travel partners such as Hyatt, Marriott, United, British Airways, Korean Air. The 80,000 points is worth a MINIMUM of $1,000 towards travel!

Card benefits include:

- Earn 3x points (up to $150,00 spend) on: Travel; Shipping purchases; Internet, cable, and phone services; and Advertising purchases made with social media sites and search engines

- Cell phone insurance if you use this card to pay for your monthly cell phone bill. If something happens to your phone, you’ll receive up to $600 in protection per claim against damage or theft. This for you and any other lines listed on your bill! You are also eligible to put in three claims per a 12-month period. There is, however, a $100 deductible.

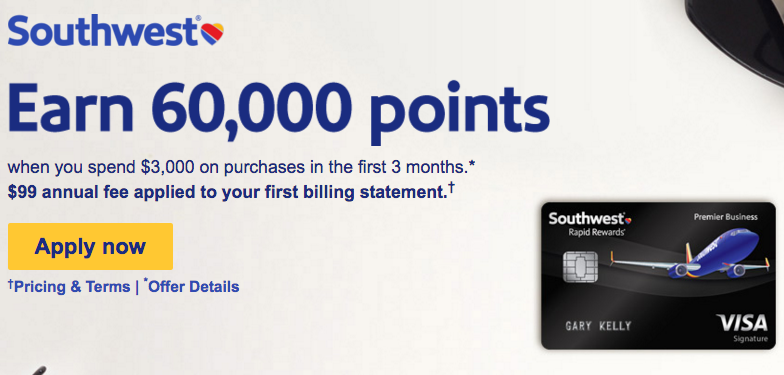

60,000 Southwest Points

Key Links: Blog Post; Application Link

Just the Southwest Business Credit Card is offering 60,000 points after meeting the minimum spend. The 60,000 points is worth approximately $840 towards travel on Southwest.

The absolute best part of the credit card is that the points earned count towards the Southwest Companion Pass. To earn the Companion Pass you need to earn 110,000 qualifying points within a calendar year. While the two personal cards are only offering 40,000 points, if you apply for one personal and one business, that will still give you 100,000 points towards earning the pass. The Companion Pass allows someone to fly with you an UNLIMITED number of times fore FREE (plus taxes) for the life of the pass. The Companion Pass expires December 31st the following year after you earn it. If you want the Companion Pass for 2017 and 2018, you want all 120,000 points to post by the end of this year. If you want the Companion Pass for 2018 and 2019, you’ll want to wait for the points to post on January 1, 2018 – that means do not meet the minimum spend until this date. The points will then post a few days after the statement close date.

Disclosure: This post contains affiliate links. Thank you in advance for supporting the blog and enjoy traveling on a deal!

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.