UPDATE: This offer has expired.

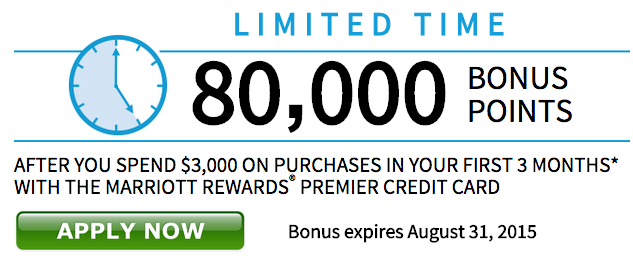

Marriott just announced a new limited time offer for the Marriott Rewards® Premier Credit Card. Through August 31, 2015, you can receive 80,000 points after spending $3,000 on the card in the first 3 months from account opening. This is probably the highest offer I’ve ever seen and is available for both the personal and business version of the Premier card. Although I do want to point out that the annual fee is not waived for the first year and there is no category 1-4 free night certificate included in the offer (two things that have been common with Marriott offers in the past).

Now, for whatever reason, Marriott typically has many different offers available at the same time and the existing 70,000 point offer that I’ve written about in the past is still available. While this offer is 10,000 less points, it waives the annual fee for the first year and gives a category 1-4 free night certificate upon account approval. Ultimately it comes down to how you redeem your Marriott points and what you value them at. I personally get at least 1 cent per point. You can read this prior blog post to learn more about this offer.

My Favorite Card Benefits

Regardless of which offer you apply for, the perks that come along with the card on an annual basis is the same. With the Premier card, you’ll get a free night annually that can be used at any category 1-5 hotel. This is one of the best perks of the card in my opinion. The certificate is good for 6 months from your card renewal, although many years I’ve been able to get Marriott to extend the expiration date. I typically use my free night at a hotel that would cost me $150-$200/night. This covers the $85 annual fee plus more.

Additionally, the card comes with 15 nights a year towards status. This will guarantee you silver status, but can also help you earn Gold or Platinum. These 15 nights get added to your account when you apply for the card and then every 12 months thereafter. You can also earn 1 night towards status for every $3,000 spend on the card. If you are interested in credit cards that will help you towards status, make sure to check out this post.

The card (along with many other Chase cards) also come with travel insurance/reimbursement. I personally ONLY use a Chase credit card when booking my flights due to these benefits.

- Trip cancellation insurance — Reimbursement of non-refundable passenger fare due to covered cancellations and emergencies when tickets are purchased with your card (for both silver and premier card)

- Trip delay reimbursement — If your trip is delayed by more than 12 hours due to a covered event, you can be reimbursed for reasonable expenses, like meals and lodging (for both silver and premier card

My Take on the Marriott Premier Credit Card

I personally have had the premier version of for the past 10 years. It is actually the first points earning credit card I ever applied for! At that time I was staying at Marriott hotels 100+ nights a year and it was a great card to use to get 5 points per dollar spent on all my stays. Even though I do not use the Marriott card often anymore (my travel habits have also changed), it is still one that I keep in my wallet as I feel as though I get more out of this card than the $85 annual fee (for the personal version). You can read more about hotel credit cards where the benefits outweigh the annual fee here.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

If you have multiple Marriott cards, do the 15 nights stack (2 cards, maybe one personal and one business = 30 nights’ credit towards status)?

FYI: I think the regular 70,000 mile offer is expired now. 🙁