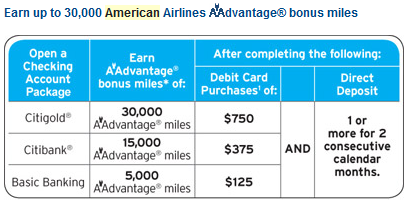

I received an email yesterday for a very lucrative AAdvantage offer by opening up a Citibank Checking account. There are three different offers depending on the checking account opening. The highest one being 30,000 AAdvantage miles, which is enough miles for a roundtrip domestic ticket (in coach) or a one way ticket to Europe (in coach). Since this is a checking account it will not pull your credit like applying for another credit card, which is great.

- Open the checking account by October 31, 2012

- Within 60 days you must complete the two following activities:

- Meet the minimum spend on the debit card (for the 30,000 mile offer it is $750)

- Set up direct deposit to the checking account for 2+ consecutive months

- The AAdvantage® bonus miles will be posted by Citibank to your American Airlines AAdvantage® account within 90 days from the end of the statement period in which you met all offer requirements

To open an account:

- Apply online (and make sure code CY4Y is already populated in the offer code box)

- Citigold Account package (to avoid the monthly fee must have $50,000 for all linked deposit or retirement accounts)

- Citibank Account package (to avoid the monthly fee must have $15,000 for a combined average balance)

- Basic Banking package (to avoid the monthly fee must have $1,500 for a combined average balance; you also must make 1 direct deposit and 1 bill payment each monthly statement period OR keep a combined monthly average balance of at least $1,500)

- Call 866-579-8496 and mention code CY4Y

- Visit a Citibank branch and open the account

You can read about the three different accounts and their terms here.

NOTE: In the past year Citibank has been sending out 1099 for miles earned, so you do risk the chance for getting a 1099 if partaking in this offer. They’ve also been putting a high value on each mile. From what I’ve read in Flyertalk, last year Citi valued the miles at 2.5 cents per mile. For amounts less than $600, companies are not required to send a 1099, however, that does not mean you are not supposed to report it as taxable income (keep in mind, I am not an accountant!). This means the 30,000 miles could potentially generate a 1099 form, but the 15,000 miles will not.

Also, the terms in the email do state: “This offer is available to Citi cardmembers who receive this communication. Offers for new checking customers only, 18 years or older. All accounts subject to approval and applicable terms and fees. Limit of one offer per customer and account. Offer may be modified or withdrawn at any time without notice, expires 10/31/2012, is not transferable and cannot be combined with any other offer. If you have received a bonus reward for opening a new Citibank consumer checking account within the past two years you will not be eligible to receive a bonus associated with this offer.”

I’ve personally taken advantage of these offers in the past (without being targeted, so it still worked for me) and have earned many AAdvantage miles this way. However, I must admit, getting the points did require a few phone calls after the 90 day period and a lot of following up, so just a warning. At the end of the day though, it was absolutely worth it. The hard part for many will be being able to set up the direct deposit component. I am able to easily do this with my work, but if you have any suggestions for those who have it more challenging, I am all ears.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Hasn’t there been issues with Citibank sending out 1099s for the inflated value of the miles in the past?

I also received that offer through email and through snail mail. I am not going to go for it however cause the T&Cs state that if you have received a bonus in the last 2 years your are not eligible. Also I read in another blogger’s website that they report this as a 1099 to IRS.

I’m curious how you can meet the direct deposit requirement if you don’t get a regular paycheck which is what is typically used in this situation?

For example, could I just do an electronic bill pay from another bank account that sends $500 or $1,000 each month to the new Citi account?

If not, is there some other setup that will work?

Thanks,

-Rudy

Yup. Not worth the 1099. Pass

Has anyone recieved the bonus miles 2 separate times since they started adding the “not eligible if you’ve received this bonus in the past 2 years” language? Curious If this restriction is something they actually track / enforce.

[…] 30,000 American Airline Miles with Citibank Checking Account […]

You should also mention the IRS reporting that Citi does on these accounts. Why was this not mentioned???

Thanks all for pointing out the 1099 potential. This was not the case when I received the miles, but you are correct, Citibank has started to change the way they operate.

I signed up for this offer last summer and indeed got a 1099.

In the grand scheme of things, to me, a 1099 for $750 (IIRC) is not going to make a bit of a difference at tax time, so I’m not opposed to making the easy miles and calling it a day.

What worries me now is the 2 year language, so I might need to chat with someone at the branch and see what they say.

@viguera – thanks for letting us know your experience with the 1099.

Does anybody know the amount that is reported on the 1099? Hard to determine if this is worth it without knowing the cost associated with it.

Thanks.

Gold accounts = $30 fee per month… what’s the downside of opening acct, meeting min spend, doing direct deposit for 2 months, waiting for points to post, and then cancelling within 3-4 months? blacklisted from citi? hit on credit?

@viguera – thanks!

[…] 30,000 AAdvantage Miles for opening CITI checking account document.write(''); http://boardingarea.com/dealsw…cking-account/ […]

Can you sign up for this if u already have a citi checking account which gave you 20,000 Thank You Points?

@guest – In the terms it says you can’t get another bonus if you have received one in two years. Although no way to know just yet if that will hold.

The $30 fee is the block to me.

On the 1099 issue, look at the minimum spend wrinkle, see how it scales with the miles in a constant ratio. We won’t know till 2013, but it looks to me that they are massaging it so that the award will be structured as a tax free rebate, not a taxable bonus.

Slightly OT, but any ideas about funding the minimum balances with cc that won’t be treated as a cash advance?

Tempting but I think I will pass on this one.

$30 Fee * 5 months = $150 + (potential) $750 1099 * (roughly) 25% = $187 in taxes

Total Cost = $337/30,000 miles = 1.125 CPM

Not a bad price but not worth the hassle for me. Maybe the 15,000 offer is better for me since, from my understanding, would not create a 1099.

$20 fee * 5 months = $100/15000 = 0.6 CPM

@PJ – I think the $30 monthly fee is the extent of the downside. I opened an account, met requirements, received bonus miles, and closed account earlier this year, and then received this offer this week, so have not been blacklisted. When I signed up for the account, I asked if there would be a credit inquiry and they said no. Not sure about any impact from closing a checking account, but I’d be surprised if there was.

When I received the offer earlier this year, it was for 23,500 miles, which at first I thought of as a random amount, but after reading another blog a commenter pointed out that at Citi’s self-created 2.5 cents per mile of value, the 23,500 miles fell just below Citi’s self-imposed threshold of $600 to necessitate distributing a 1099, i.e. they slightly lowered the bonus amount from the prior 25,000 in response to complaints about the 1099s.

However, this new 30,000 offer kind of blows that whole 1099-avoidance theory up – unless, of course, it means that Citi has decided to stop distributing the 1099s, and, without that self-imposed restriction, feels that 30,000 miles is the appropriate promotional amount to maximize new account signups. Here’s hoping that’s the case.

No worries.

My wife and I both opened accounts last year and triple-dipped by earning miles with the AA debit card (which they no longer offer) and used it for re-engagement challenges to activate old expired miles, plus the bonus miles for signing up, so it was a no-brainer.

I’ll chat them up online now or go to the branch this weekend to find out if they even care about the 2 year condition.

One thing to remember is that depending on your employer, Citi will waive the fees and minimum balance if your account qualifies for “Citi at Work” so you might want to ask about that.

I got the email – but when I called they said I wasn’t eligible because I have a citibank checking account. they said it was a mistake for them to send it to me. HUH?

@Kathy – In the terms it does state for new customers only, but who knows.

This has already been hashed out, you do not need to report these miles as income despite what Citi sends you.

Not that it matters for me, since I’ve been banned for life with these guys due to the awesome Citi USA stuff a few years ago. Totally worth it though. Way better than the mint.

@deals. I know, but all of my accounts are linked. first, they send me a targeted invite, then tell me it was their error to send it. sounds fishy…..

@Kathy – Yeah that sounds weird. I will say, I did this a year or so ago and already had many Citi accounts and still got my points.

@Kathy I already have a citi checking and I also received email.

how long does it usually take to get my account open/card delivered after I apply online? Any hints?

@jim – I did this awhile ago, so I do not remember exactly, but it is fairly quick.

I just called them and opened a citigold account. They asked me to deposit a minimum of $500 to open the account, which I did, by giving them my other bank’s account number and routing #. Then the rep repeated the same terms as listed in this blog: charge $750 to the debit card and have 2 consecutive direct deposits in 60 days to receive the 30,000 AA miles. The $30 monthly fee for not having $50k or more deposited does not kick in until after 60 days. I just realized the rep didn’t ask me for my AA account #. So altogether not bad. I just hope they don’t take too long to give me the AA miles after the 60 days.

[…] up to 30,000 AA miles by opening a Citi checking […]

How simple is it to close the account (after the miles hit)?

@Dick613 – Closing an account should be pretty simple, although I have actually never closed a Citibank account so I cannot speak from past experience. I do have a few accounts with like $2.50 in them though.

@Dick613. I just recently closed an account with Citibank (april) and all I had to do was send them a secure message and ask them to please close it and send me the check.

@deals – I’m late to the party here. Can you recommend how a current (regular) Citibank checking customer should apply for this deal to get a Citigold account and get the points – online, phone, or in-person? Since you said you had many Citi accounts and still got my points, it sounds like you went through that process. When I start the online account opening process while signed in to the Citi site it’s unclear to me if the CY4Y code is being run through.

@deals the $750 spend on citigold do I need to use the debit card with pin during purchase or can use credit? Thanks for any info.

@Chris – You can apply online or in over the phone. When you apply online (which is probably the easiest), just make sure offer code “CY4Y” appears in the box. It should be automatically there just by clicking the link above in this post. It is in the lower-right section of the page. Does this help?

Thanks, @Deals. But specifically re: applying online, should you be logged in as a current Citi customer…or not?

Also, when applying over the phone, again as a current Citi checking customer, will the phone rep exclude you from the promotion?

I’m wondering specifically how to get around the “for new checking customers only” fine print.

@Chris – I did this a few years back so cannot 100% remember what I did, but I know I applied for a different account than what I had.

Does this Citi debit card earn AAdvantage miles per $1 spent?

@TRW – No, there are no longer any Citi debit cards that earn miles. @Deals, the phone reps are quite clear about current account holders being ineligible for the miles, even if switching to a new type of account. The guy I spoke to said that some people “sneak through,” but 9 times out of 10 they go back at some point in the process and see of the applicant has another Citi checking account…and if they see that they will stop the issuance of the miles.

@Chris – Good to know, thanks.

[…] in September I wrote about a promotion where you can get up to 30,000 American Airline Advantage miles by opening a new Citibank checking account. That promotion has since ended (10/30/12), but View from a Wing reports that the promotion is up […]

deals,

can you add the capability on your site where the date shows for each of the replies/post? That way we know if the comments are recent or old. Thx.

@ff_lover – Great suggestion actually. I am currently away on vacation, but when I get home I’ll work on it. Hope it is possible!

I currently have a regular Citi checking account (opened 7 years ago), if I close it within the next few days and then try to get in on this offer in a couple of weeks, would that work? Technically I won’t be a current checking customer and I have not received a bonus for opening an account within the last 2 years… Those that have experience with opening checking accounts and getting bonuses, please let me know what you think. TIA

[…] 30,000 American Airline Miles with Citibank Checking Account … […]