UPDATE: This offer has expired.

Back in November, Capital One announced some incredible credit card offers—probably the highest offers I’ve ever seen in the credit card world actually. Both the Capital One Spark Cash for Business and the Capital One Spark Miles for Business will allow you to earn up to $2,000! While this offer has been around for a few months now, this offer is expiring in less than one week on January 28, 2019.

- Capital One Spark Cash for Business:Â Earn the normal $500 when you spend $5,000 within the first three months, plus earn an additional $1,500 when you spend $50,000 on the card within the first six months

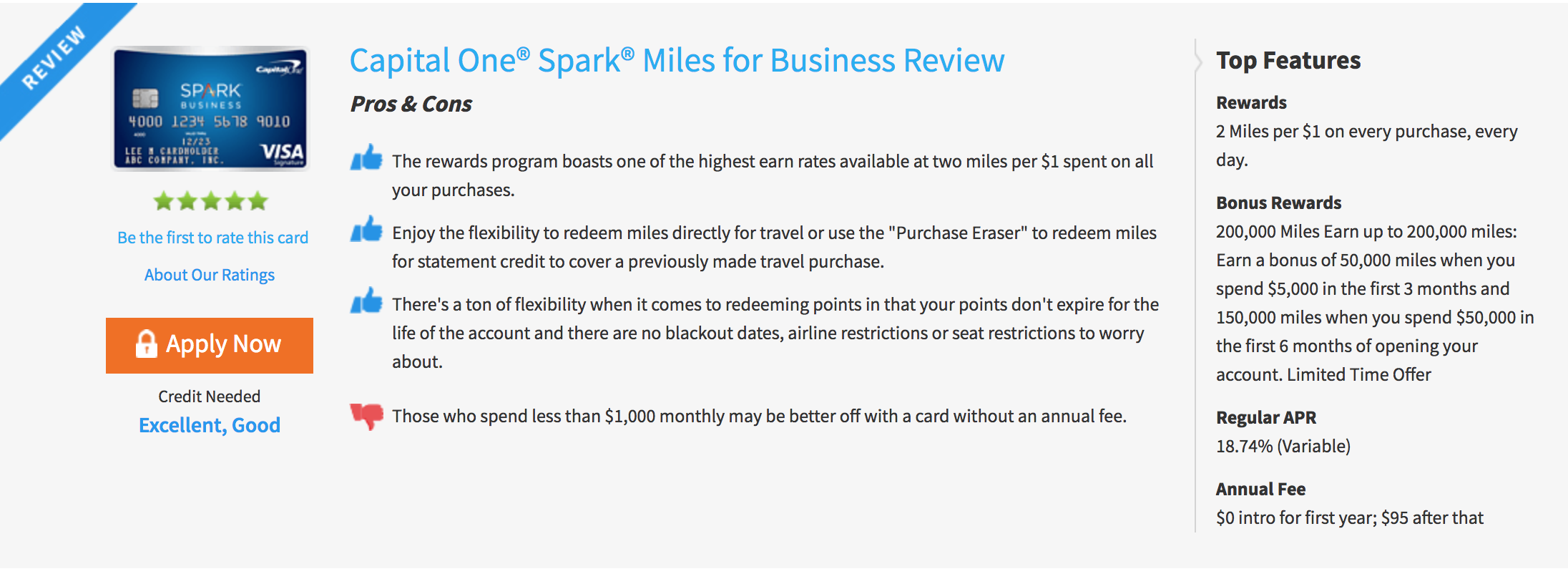

- Capital One Spark Miles for Business:Â Earn the normal 50,000 miles when you spend $5,000 on the card within the first three months, plus earn an additional 150,000 miles when you spend $50,000 on the card within the first six months

So with the Capital One Spark Cash for Business you can earn up to a whopping $2,000 and with the Capital One Spark Miles for Business you can earn 200,000 miles – pretty awesome, right?! While spending $50,000 on your card within a 6 month time frame is definitely challenging for many, if you have high spend this is definitely the #1 card that should be on your radar! Remember, this is the bonus points or cash you earn in addition to the 2 points per dollar spent/2% cash back earned for your regular spend. So at the end of the day, after you spend $50,000 on the card, you’ll actually end up with $3,000 or 300,000 points, depending on the card you apply for!Â

Difference Between the Cash vs. Miles Card:

The cards are very similar in nature where they both have a $95 annual fee (although waived the first year), but with one card you’ll earn straight up cash back where the other you’ll earn miles. With the Capital One Spark Cash for Business you’ll earn a fixed 2% cash back for all purchases. So with the sign up offer, you’ll earn $1,000 on the $50,000 spend (2% of $50,000 is $1,000), plus $2,000 for meeting the $50,000 minimum spend, for a grand total of $3,000!

But with the Capital One Spark Miles for Business you’ll earn a fixed 2 points per dollar spent towards travel. So with the sign up offer, you’ll earn 100,000 points on the $50,000 spend (2 points per dollar spent with $50,000 is 100,000 points), plus 200,000 points for meeting the $50,000 minimum spend, for a grand total fo 300,000 points. You can then redeem your points towards travel purchases at a fixed 1 cent per point, ultimately resulting in 2% back on all your purchases.

Earning Miles Might Be Worth More!

Just last month, Capital One just announced that miles earned from their Venture or Spark cards can be transferred to partner airlines instead of just redeemed at a fixed amount towards travel. If you are able to get more than a 2% return of your points, then transferring your points is huge and will make this offer worth even more! There will be 12 partner airlines to start off with, although they are all international carriers: Aeromexico Club Premier, Air Canada Aeroplan, Alitalia MilleMiglia, Avianca LifeMiles, Cathay Pacific Asia Miles, Etihad Guest, EVA Infinity MileageLands, Finnair Plus, FlyingBlue (Air France & KLM), Hainan Airlines Fortune Wings Club, Qantas Frequent Flyer, and Qatar Privilege Club.

Overall…

This is by far the best credit card offer at the moment for high spenders. I also love that everyone is guaranteed to earn up to the $2,000 value and it isn’t based on getting some ridiculously high value on your points when redeemed at a hotel or flight.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Does it really make sense to spend on Sparks Mike card beyond earning bonus or other cards trump it

@Sam – It is the same as using any 2% cash back card. If you like cash back, then yes, it is great. If you prefer miles, I personally wouldn’t opt for a different card as I am not a fan of the airline partners. But if those are airline partners you typically use then its a good card as it gives you the flexibility.