Earlier this month Chase unveiled a brand new credit card — the Chase Freedom Flex. During that announcement, just the details were available, but no application link. Well, the time has come and you can now apply for this highly regarded card. It is a no annual fee card, with great bonus categories and a decently strong sign-up offer.

Learn more about the Chase Freedom Flex

Earn many Chase Ultimate Reward points

For a no-fee annual card, you can actually end up with a huge amount of points on your every day purchases. And although this card technically earns cash back, if you have a more premier Chase Ultimate Reward card, such as the Chase Sapphire Preferred, Chase Sapphire Reserve, Chase Ink Preferred, you can transfer your points to one of those accounts instead and then redeem for travel opportunities at a better rate.

For example, if you earn $200 cash back, that really earns you 20,000 Chase Ultimate Reward points. You can either opt to redeem those points for cash back, or if you want, can transfer them to a premier Chase credit card. You’ll then have 20,000 points to transfer to partner programs, such as Hyatt, Marriott, United, JetBlue, Southwest British Airways and more.

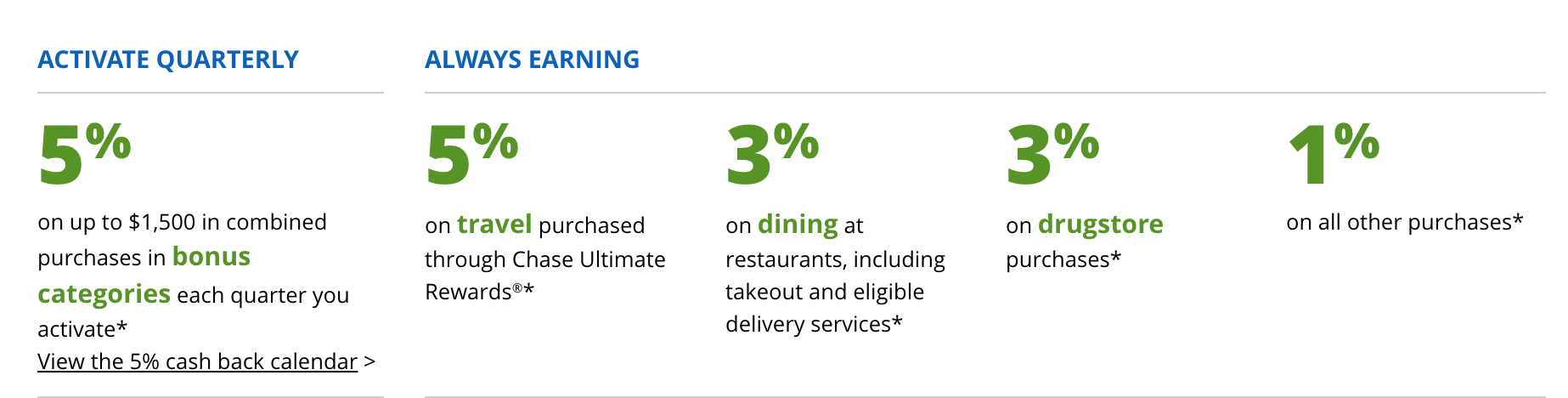

With this card, you’ll earn:

- 3% cash back on drugstores

- 3% cash back on dining out or takeout and eligible delivery services

- 5% on travel booked through Chase Ultimate Rewards

- 5% cash back on rotating quarterly categories

- 1% cash back on everything else

This is similar to the no-longer-available Chase Freedom card with the same 5% cash back on rotating categories, but now you get an additional 3%-5% cash back on many more categories. Many drugstores sell gift cards to third-party merchants, as well as Visa and Amex, so this could be an opportunity to earn bonus points at many other retailers.

Receive many benefits with this card

The other big difference is that this card is with Mastercard – not Visa — where you’ll receive some pretty amazing World Elite Mastercard benefits. These benefits include:

- Cell phone insurance: Up to $800 per claim and $1,000 per year in cell phone protection against theft or damage

- Lyft: $10 in credit for every five rides taken in a calendar month, automatically applied to the next ride and capped at once per month

- Boxed: 5% cash rewards on Boxed purchases for use on future purchases

- ShopRunner: Free membership to receive two-day shipping and free return shipping

- Fandango: Double VIP+ points for movie tickets

The best benefit, in my opinion, is the cell phone insurance. I have always used a card that comes with this benefit, and it is huge. Usually this is a benefit that comes with a more expensive card, but to receive it on a no-annual fee card is huge.

Final words

Overall, I am thrilled to see a new card available, especially with such huge enhancements to earning Ultimate Reward points. This card will be great for drugstore and restaurant purchases as well as the rotating category bonuses. I am also extremely excited about the cell phone insurance since it is quite rare to see such a rich benefit with a no annual fee card.

Chase Freedom Flex

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Wonderful news! What do current Chase Freedom card holders need to do? If they product-change, will they get the bonus? Do they need to cancel in order to be able to apply for the new Freedom Flex card and, if they do and are under 5/24, will they be eligible or be shut out for 24 or 48 months? These details are crucial!

Thanks for the heads-up, Jen. We currently have the Chase Freedom card…will be looking forward to enhancements and maybe upgrade to new card.

The disappointing thing about the Flex is that to earn the cell phone insurance benefit, you must pay your cell phone bill each month with the Freedom Flex card. My carrier is Verizon and if I pay my monthly cell phone bill with a credit card they charge me an extra $10/mo per phone line…so I would be paying $40/mo or $480/yr for cell phone insurance.