The end of the year is coming to an end so that means you want to make sure you use up any travel credits you have from credit card benefits, specifically the Chase Sapphire Reserve. If you applied for the card on or before May 20, 2017 you have $300 of travel credits to spend per calendar year. If you applied for the card after this date, the $300 travel credits is per cardmember year, not calendar year. You can learn more about this change here.

This means you have $300 to spend on anything travel related. But the one caveat is that this must be done by your December statement close date, you do not actually have until the end of the calendar year. So if your statement close date is December 4th, for example, any amount spent will count towards your 2018 travel credit. If your statement close date is not until December 12th or later, you still have time to make sure you spend the entire amount.

Of course, the best scenario is if you have a travel related purchase to make. But in case you do not have any travel purchases now, here are some ideas:

- American Airlines e-gift card

- Delta Airlines e-gift card

- Marriott gift card

- AirBnB gift card

- Disney Vacation account funding

- Purchase a Southwest flight – you can then cancel it for no fee and use the voucher towards a future flight (just remember that the voucher is not transferrable and expires one year from the date the ticket is purchased)

- Of course you can always purchase a fully refundable airline ticket and after receiving the travel credit cancel your flight. I am just not 100% if the travel credit is then revoked – anyone have personal experience?

Anyone have any other non traditional travel purchases that were reimbursed?

How to Find Your Chase Sapphire Reserve Travel Credit

- Go to the Chase Ultimate Rewards site and sign in with your Chase username and password

- If you have multiple Chase Ultimate Reward earning credit cards, select your Chase Sapphire Reserve card

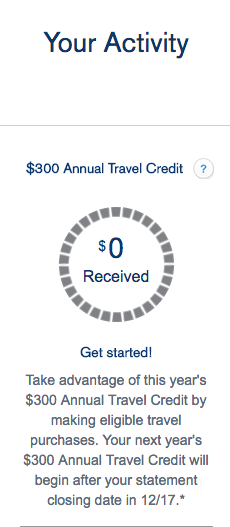

- Scroll down a little and on the right hand side you’ll see “Your Activity”

- If it says “$0 Received” or anything less then $300, you need to spend that travel credit (as long as your statement close date has not passed. It will actually tell you when you need to spend the travel credit by. In the example above you’ll see it says “Your next year’s $300 Annual Travel Credit will begin after your statement close date in 12/17.” That means you have until December 16 to spend the money. Your statement closing date will be different. You’ll need to look at your statement to see your specific date. In the example above it is 12/16.

How will you spend your Chase Sapphire Reserve travel credit?

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

“Your next year’s $300 Annual Travel Credit will begin after your statement close date in 12/17.” That means you have until December 16 to spend the money

—The “12/17” means December 2017, therefore the date is not December 16th, it is the individual’s statement close date (which varies by person)

@Dr. Bob – Correct, everyone has a different statement close date. To ensure no confusion I included another disclaimer that this is just an example and that your statement close date will differ.

Earlier today I sent an inquiry about the Chase Sapphire Reserve card before seeing this article.

I’m wondering if it is worth another $450 for the annual fee that would be added to my February 2018 bill. With the $300 credit, the card will cost $150 and there are not bonus points this year.

If I cancel the card, what happens to my points? Can I open a no annual fee card and transfer the points? A few years ago, I got an AMEX Every Day card and moved my points from an AMEX card that had a fee of $175. I also pay for the AMEX SPG card and a couple of others (Southwest Airlines and Alaska Airlines which offered free companion passes – so I don’t want to go overboard on the annual fees).

Any input would be appreciated! Thanks.

@Andrea – Whether or not the $150 net annual fee is worth it depends on how you value the benefits and what other cards you have. This card has a ton of benefits, but you might already get them with some other cards you have. Such benefits include Trip Delay/Cancellation Insurance, Priority Pass (for lounge access). Also, your points are worth more if you book directly through the Chase Ultimate Rewards travel site (1.5 cents per point). If you cancel the card you need to either transfer your points to another Chase Ultimate Reward earning card or redeem them prior to canceling (can transfer to a partner loyalty program). Remember, not all Chase cards allow you to transfer points to a partner program (i.e., all no annual fee cards).

Hope this helps! Let me know if you have any other questions.

Thanks! I’ll do some math and see if it makes sense to keep the card. Probably will for another year …. I’ve just got too many cards now and it is greeting a little complicated.

Best regards …..