Update: These offers have expired.

Right now there are a ton of increased credit card offers available! Below is a recap of some great credit cards and offers for the month of May.

1-3. 75,000-125,000 Hilton Honors Points

Earlier this year year, Hilton launched many new co-branded American express credit cards. And just last week they ended up increasing the offer! Right now, you can actually earn up to 300,000 points with these welcome offers. There are two personal cards (one with an annual fee of $95 a year and one with no annual fee) and one business credit card.

Personal Cards:

- Hilton Honors Ascend Card from American Express – Earn 100,000 Hilton Honors Bonus Points after you spend $3,000 in purchases on the Card within your first 3 months of Card Membership. $95 annual fee. Plus, earn a free weekend night award after your first anniversary of Card Membership. Offer ends06/27/2018. *Terms apply.Â

- Hilton Honors Card from American Express – Limited Time Offer: Earn 75,000 Hilton Honors Bonus Points with the Hilton Honors Card after you use your new Card to make $1,000 in eligible purchases within the first 3 months of Card Membership. Offer ends 06/27/2018. No annual fee. *Terms apply.Â

Business Card:

- Hilton Honors American Express Business Card – Limited Time Offer: Earn 125,000 Hilton Honors Bonus Points after you spend $5,000 in purchases on your Card in the first 3 months. $95 annual fee. *Terms apply.Â

The business version of the card is a brand new card which means everyone is eligible for the welcome bonus. The Ascend card (personal version), however, is a rebrand from the Hilton Surpass card, so if you’ve had that card in the past, unfortunately you will not be eligible for the welcome offer again due to American Express’s once is a lifetime rule.

With the cards that carry the $95 annual fee you’ll earn Gold status as long as you are a cardmember. The card that comes with no annual fee will only give you Silver status. While having any sort of status is great since you’ll receive your 5th night free on award redemption, only Gold status will give you complimentary breakfast, and based on availability a room upgrade and concierge floor access.

Also, with the two card that cary an annual fee, if you are able to spend $15,000 in purchases on your card in a calendar year, you’ll receive a free weekend night reward certificate. This certificate is valid at almost all Hilton properties regardless of category or price. There just needs to be a standard room available and it has to be on a weekend. You can also earn this certificate every single year – it is not just a one time offer.

4. 100,000 American Express Membership Reward Points

Key Links:Â Blog Post

The The Business Platinum® Card from American Express OPEN just upped its publicly available offer where you can receive up to 100,000 points. While this is a great offer, the minimum spend is ridiculously highly making it unobtainable for many folks. You’ll need to spend $25,000 on the card within the first 3 months to earn the full 100,000 bonus points! However, if you are able to generate this much spend on the card that is great and definitely an offer I suggest taking advantage of. This high of an offer doesn’t come around too often, so I am glad to see it pop up again – and available through August 8, 2018!

- Limited Time Offer: Earn up to 100,000 Membership Rewards® Points. Earn 50,000 Membership Rewards® points after you spend $10,000 & an extra 50,000 points after you spend an additional $15,000 all on qualifying purchases within your first 3 months of Card Membership. Offer ends 8/8/18. *Terms Apply.

Although this card comes with an incredibly high annual fee of $450, there are some great perks with the card. For example, you’ll receive:

- Up to $200 airline credit per calendar year (so up to $400 in credits for your first cardmember year)

- Complimentary access to select airport lounges

- Free Global Entry – you will receive a statement credit for $100 after applying and paying the $100 application fee for the Global Entry program

- Starwood, Marriott, and Hilton Gold Status

- For purchases over $5,000 you’ll earn 1.5x points on your purchase (up to 1 million bonus points per year)

- When you use your Membership Rewards Pay with points for all or part of a flight, you’ll get 35% of your points back for both: 1) First and Business Class tickets with all airlines available with American Express Travel; and 2) Economy class tickets with your selected qualifying airline (same airline as your $200 statement credit).

Depending on how you value the benefits/perks, they can definitely outweigh the annual fee!

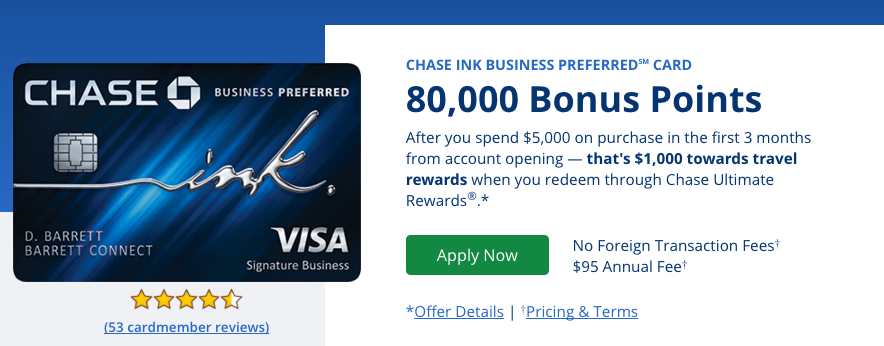

5. 80,000 Chase Ultimate Reward Points

Key Links:Â Blog Post;Â

With the Chase Ink Business Preferred Card you’ll earn 80,000 Chase Ultimate Reward points after you spend $5,000 on the card within the first 3 months. This is one of the best credit card offers out there right now and the highest way to earn Chase Ultimate Reward points. With Chase points, you can either use your points to book through their travel portal where 1 point is worth a fixed 1.25 cents towards your trip or you can transfer your points to their travel partners such as Hyatt, Marriott, United, British Airways, Korean Air. The 80,000 points is worth a MINIMUM of $1,000 towards travel!

Card benefits include:

- Earn 3x points (up to $150,00 spend) on: Travel; Shipping purchases; Internet, cable, and phone services; and Advertising purchases made with social media sites and search engines

- Cell phone insurance if you use this card to pay for your monthly cell phone bill. If something happens to your phone, you’ll receive up to $600 in protection per claim against damage or theft. This for you and any other lines listed on your bill! You are also eligible to put in three claims per a 12-month period. There is, however, a $100 deductible.

6. $500 Cash Back / 50,000 Chase Ultimate Reward Points

Key Links:Â Blog Post;Â

Similar to the card above, you’ll also earn Chase Ultimate Reward points, but this card comes with no annual fee! The Chase Ink Business Cash Card has its highest limited time offer yet.  Currently, you’ll earn 50,000 points after you spend $3,000 on the card. You can redeem the 50,000 points for $500 cash back or if you have a Chase Ultimate Reward “premier†card, instead of cashing out your points for $500, you can transfer them to your Chase Sapphire Preferred, Chase Sapphire Reserve, Chase Ink Preferred, etc. and get even more value out of your points. You can then use your points through the Chase travel site or can transfer them to a partner loyalty program (i.e., Hyatt, United, British Airways, etc.). So while the offer for this card is worth at least a fixed $500, I personally value the points at about $1,000! (when transferred to another Chase Ultimate Reward card).

Card benefits include:

- Earn 5% cash back/5x points at office supply stores and internet/cable/phone services (up to $25,000 spent per anniversary year)

- Earn 2% cash back/2x points at gas stations and restaurants (up to $25,000 spent per anniversary year)

- Earn 1% cash back/1x point on all other purchases

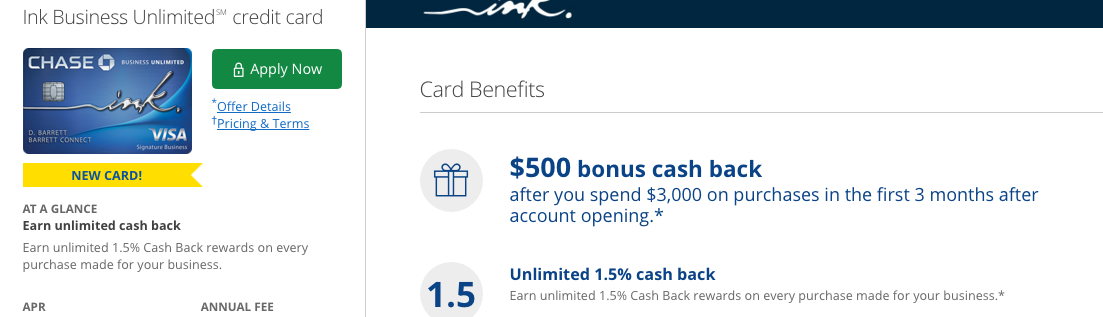

7. $500 Cash Back / 50,000 Chase Ultimate Reward Points

Key Links:Â Blog Post;Â

This is a brand new card and is very similar to the card above! The Chase Ink Business Unlimited Card is also offering the same 50,000 points after you spend $3,000 on the card. You can redeem the points for $500 cash back, or similar to the other no annual fee Chase Ultimate Reward cards, if you have another “premier” card, you can transfer your points to one of those cards and then transfer them to a partner loyalty program to potentially get even more value out of your points. This card offer is worth at least a fixed $500, although if you have another Chase Ultimate Reward card (one that comes with an annual fee), I personally would put about a $1,000 valuation on the points.

The main difference between this card and the Ink Business Cash card described below is that there are no category bonuses when earning points. You’ll earn a fixed 1.5% cash back/1.5x points on every single purchase. This is a great card for your everyday purchases and for those purchases that typically do not fall into an increased bonus category.

8. 100,000 Marriott Points

Key Links: Blog Post

The Marriott Rewards® Premier Plus Credit Card is a brand new card offering 100,000 points after you spend $5,000 on purchases in the first 3 months from account opening. This is an extremely generous offer as I value Marriott points around 0.75 cents per point, so worth around $750. And possibly even more depending on how you you redeem your points! This is definitely a card I recommend not only for the welcome offer but for the benefits as well! You are eligible for this card if you’ve never been a Marriott Rewards Premier cardmember (the previous version of the card) or if you no longer have the card and it has been more then 24 months since you’ve earned a bonus offer.

While the sign up bonus is pretty great, this card also comes with a free night annually that makes the $99 annual fee well worth it. This free night is valid at any hotel that costs 35,000 points or less. This is significantly better then the previous Marriott Rewards Premier card as that free night will only be valid at hotels costing 25,000 points or less. You’ll see from new Marriott award chart chart that this will cover 5 out of the 7 hotel categories come August 2018. This means you can use the free night certificate at a decent number of Starwood and Marriott properties! Category 8 properties and off-peak/peak awards will not come out till 2019. There are even some properties in New York City that will be at a category 5 level (35,000 points), so I personally believe you can get a $200+ value out of the free night if used the right way!

9. 80,000 IHG Points

Key Links: Blog Post

The relatively new IHG Rewards Club Premier Credit Card is offering 80,000 bonus points after spending $2,000 on the card within the first three months. While the annual fee has increased from the previous version of the card, the $89 per year fee is still worthwhile for most. With this card, you’ll receive a free night certificate (capped at properties that cost 40,000 points or less) which can easily pay for the annual fee on a yearly basis, plus more! Additionally, when you use your points for an award stay, you’ll receive your 4th night free.

Remember though, IHG points are not worth as much as some other program currencies, so 80,000 points in this program probably will not have as high of a valuation as some of the other loyalty programs on this list. With that being said, it is still a very good offer for this card and a card that is worthwhile to have year after year. One thing to note is that this card is NOT subject to Chase’s “5/24” rule. This means that even if you’ve been approved for a ton of cards in the past two years, you will not be automatically declined for being approved for more then 5 cards within the past 24 months, like some other cards.

10. 60,000 Southwest Points

Key Links: Blog Post

The Southwest Airlines Rapid Rewards Business Premier Card (the business version) is offering 60,000 points, which is significantly more then the two personal cards.

The absolute best part of the credit card is that the points earned count towards the Southwest Companion Pass. To earn the Companion Pass you need to earn 110,000 qualifying points within a calendar year. So it is important to time your application(s) accordingly! You are also eligible to apply for one business card and one personal card so the welcome offer for the two cards can get you very close to the number of points needed to earn the pass. The Companion Pass allows someone to fly with you an UNLIMITED number of times fore FREE (plus taxes) for the life of the pass. The Companion Pass expires December 31st the following year after you earn it. So if you were to earn the pass now that means the pass will not expire until December 31, 2019!

Disclosure: This post contains affiliate links. Thank you in advance for supporting the blog and enjoy traveling on a deal!

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.