Back in September I wrote about a promotion where you can get up to 30,000 American Airline Advantage miles by opening a new Citibank checking account. That promotion has since ended (10/30/12), but View from a Wing reports that the promotion is up and running again for those who have missed out.

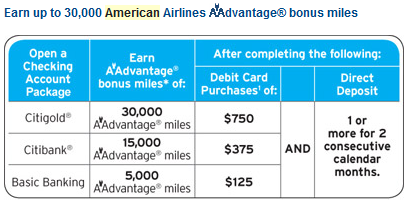

From what I read the terms are exactly the same, by the offer code is different. As I mentioned back in September, there are three different offers depending on the checking account opening. The highest one being 30,000 AAdvantage miles, which is enough miles for a roundtrip domestic ticket (in coach) or a one way ticket to Europe (in coach). Since this is a checking account it will not pull your credit like applying for another credit card, which is great.

How to take advantage:

- Open the checking account by November 30, 2012

- Within 60 days you must complete the two following activities:

- Meet the minimum spend on the debit card (30,000 mile offer = $750; 15,000 mile offer = $375; $5,000 mile offer = $125)

- Set up direct deposit to the checking account for 2+ consecutive months

- The AAdvantage® bonus miles will be posted by Citibank to your American Airlines AAdvantage® account within 90 days from the end of the statement period in which you met all offer requirements

To open an account:

- Apply online (and make sure code CY9S is already populated in the offer code box)

- Citigold Account package (to avoid the monthly fee must have $50,000 for all linked deposit or retirement accounts)

- Citibank Account package (to avoid the monthly fee must have $15,000 for a combined average balance)

- Basic Banking package (to avoid the monthly fee must have $1,500 for a combined average balance; you also must make 1 direct deposit and 1 bill payment each monthly statement period OR keep a combined monthly average balance of at least $1,500)

- Call 866-579-8496 and mention code CY9S

- Visit a Citibank branch and open the account

You can read about the three different accounts and their terms here.

NOTE: In the past year Citibank has been sending out 1099 for miles earned, so you do risk the chance for getting a 1099 if partaking in this offer. They’ve also been putting a high value on each mile. From what I’ve read in Flyertalk, last year Citi valued the miles at 2.5 cents per mile. For amounts less than $600, companies are not required to send a 1099, however, that does not mean you are not supposed to report it as taxable income (keep in mind, I am not an accountant!). This means the 30,000 miles could potentially generate a 1099 form, but the 15,000 miles will not.

Also, typically these offers are for new checking account customers who have not opened a new Citibank consumer checking account within the past two years. I took part in this promotion about two years ago and was able to get the points even though I had a citi checking account. I opened a different type of account, so that could have been why, but no idea. I did, however, have to make multiple phone calls to get the points, but that is just my experience.

If anyone has any personal successful (or unsuccessful) experiences with this, please share for other interested readers. There were close to 50 comments on the last time I posted about this promotion, so I suggest reading through those comments first if you have any questions.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Do you have to have the Citi AA card to take advantage of this offer? How will they know your AA number?

@CardinalTraveler – No , you do not need to have the Citi AA card, but you need to have a frequent flyer account with AA.

DO THEY STILL SEND YOU A 1099 TO PAY TAX ON THE POINTS?

@SPLP – As mentioned in the post, there are many reports that if the value of the points is $600+ you will receive a 1099. From previous reports, the 30,000 mile bonus can potentially yield a 1099, but the 15,000 mile bonus most likely won’t.

Does the transfer from other bank (using other banks transfer) to citi count as direct deposit ?. Any idea

@indsouth – Typically no it does not.

A silly question I’m sure, but in order to do direct deposit, do I tell my employer or do I authorize the bank to go get my $

@Grado – Every employer does it differently. For my job, I can simply go onto a site within the employer system and update my direct deposit myself. The bank will give you a direct deposit sheet though if you need to hand it to HR directly. Ultimately though, it is working with your employer, not the bank.

What have you guys heard about Paypal transfers (ACH push) to Citi checking? I’ve heard mixed things. I did this offer a couple months ago and just met the requirements about 3 weeks ago, still waiting for points. I haven’t tried calling yet. My concerns are that I couldn’t get employer DD in time (only got 1 DD for the second month) so I used PP ACH push the first month, also, I met the spend requirement w/ Walmart MO purchase.

Also, how long does it typically take for points to post based on past promotions?

I opened a citi gold account in October under the other promo. I already spent more than $750 in transactions with the card (non-pin) and sent 2 direct deposits of $125 each, one in october, one in november. My account has not been charged the $30 monthly fee for keeping less than $50k. The bank said they give you a 60 day grace period. I have no intention to put more money into the account (i now have $136). I am still waiting for the miles but others have commented it might take up to 90 days until all the requirements are fulfilled (direct deposits+spending requirement). I figured I’d pay $60 to $90 in monthly fees to get 30k AA miles. Not bad.

As soon as the miles post, I will be canceling the account. I did this with the Suntrust account and wasn’t even charged a $25 penalty fee for early closing.

For people wondering about direct deposit, I did send one from my husband’s business payroll account so it is an official direct deposit. Other people have reported that paypal doesn’t work. But other people in other sites have reported that if you go in person to the bank and open it with a rep, and tell them you are a freelancer who doesn’t get direct deposits, that somehow they wave that requirement.

Remember “Citi at Work” waives balance requirements